A look into The Challenge Behind Fully Decentralized Stablecoins

The Cost of Decentralized Stablecoins

Looking back at the development history of stablecoins, we can find that capital efficiency, price stability, and decentralization cannot coexist.

Starting from AMPL, followed by ESD, BAC, and then UST, these all tried to achieve high capital efficiency under the premise of decentralization. The result was huge price fluctuations leading to depegging and collapse.

For stablecoin projects, relative price stability is essential for survival and required for business expansion. Therefore, among the above three factors, the decision effectively boils down to a choice between capital efficiency and decentralization.

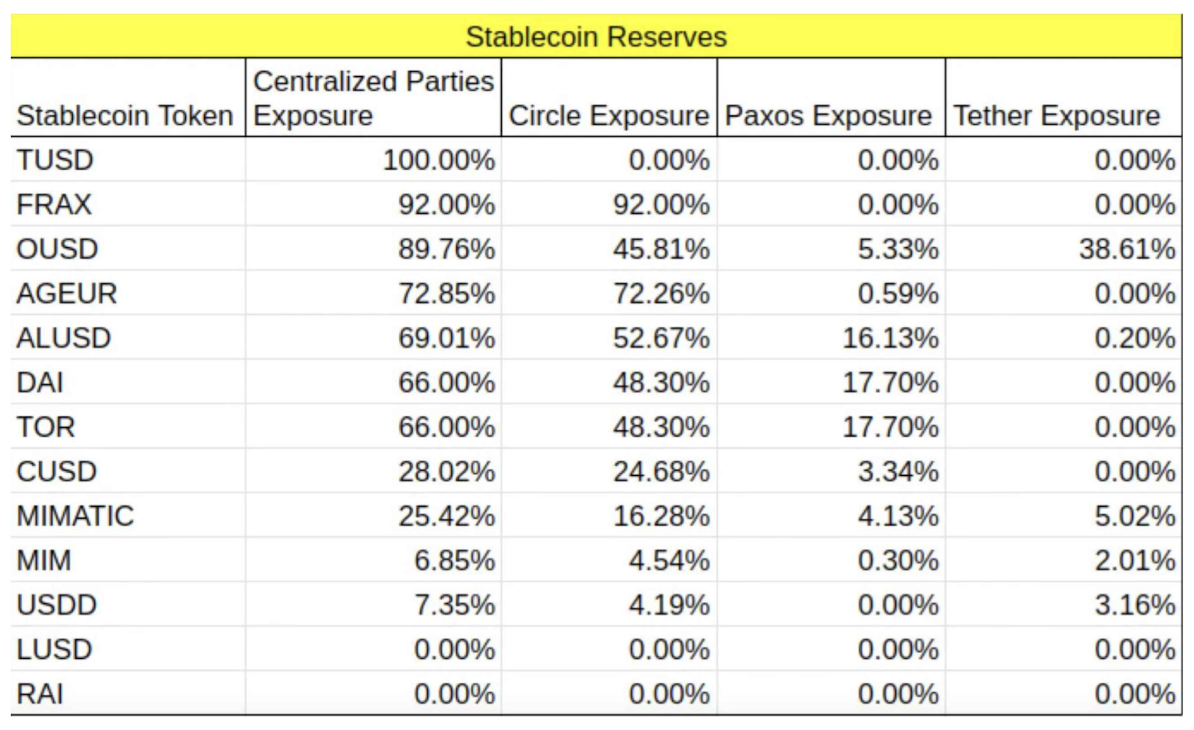

The following chart shows the centralization levels of various stablecoin protocols:

If we define a fully decentralized stablecoin as those backed entirely by decentralized assets, then within the entire Ethereum network, only LUSD and DAI are decentralized stablecoins.

Seeing that so many so-called "decentralized stablecoins" have a dependency on centralized entities exceeding 50% is surprising. Aren't stablecoins the Holy Grail of cryptocurrency? Are Tether and Circle truly the perfect solutions?

Why Doesn't Everyone Create Fully Decentralized Stablecoins?

To a certain extent, stablecoins are elusive to the majority due to the difficulty of achieving decentralization. For example, MakerDAO's DAI could be considered fully decentralized between 2019 and March 2020, but it encountered various problems:

Designing a price stability system independently is challenging, as relying solely on interest rate control is insufficient to effectively control stablecoin prices. If not handled properly, it would face long-term issues like DAI's price consistently exceeding $1.

Relying solely on ETH-based collateral affects the protocol's scalability and prospects for user acquisition.

A stablecoin generated by ETH collateral alone requires an effective liquidation system due to significant fluctuations in ETH that inevitably lead to low capital utilization efficiency. Otherwise, it may encounter events like "Black Thursday" on March 12th.

MakerDAO's solution to these issues was to introduce the Peg Stability Module, or “PSM,” allowing users to generate DAI directly using USDC. This brought about the following improvements:

DAI's price now has USDC as a hard peg, greatly enhancing price stability

After introducing USDC, it became easier to onboard users

The USDC Vault has a 100% capital utilization rate, significantly improving the protocol's overall capital efficiency

With USDC always available to supply DAI amid a stable DAI price, liquidation events become less frequent, further enhancing the protocol's security

When Curve launched, it included DAI, USDT, and USDC as the base stablecoins for its 3CRV pool, legitimizing DAI in the stablecoin field. Any subsequent stablecoin protocol that incentivized their own stablecoin via an "XYZ stablecoin-3CRV" LP would partly benefit MakerDAO. Everything seemed perfect until the crisis in the US banking system manifested.

From MakerDAO's example, we can see that for a stablecoin protocol, introducing other stablecoins as collateral is very tempting, as it can effectively:

Enhance the price stability of its own stablecoin

Improve the overall capital efficiency of the protocol

Effectively target and onboard other stablecoin holders

Regarding the third point above, new stablecoin protocols are incentivized to introduce USDC as collateral. As long as their stablecoin can offer a higher return than USDC, USDC holders have sufficient rationale to convert their USDC to the new stablecoin, creating a win-win situation between the protocol and users:

USDC holders get higher returns

The stablecoin protocol gains higher TVL, making its accompanying governance token more valuable

More valuable governance tokens lead to higher APRs, attracting more USDC holders to participate

This is the fundamental reason why some other decentralized stablecoins, such as FRAX, MIM, ALUSD, OUSD, and DOLA, have been able to grow and develop rapidly. Stablecoins like these can effectively be considered various forms of Wrapped USDC.

Thus, we can only truly appreciate the benefits of decentralization after we see the various outcomes of centralized or semi-decentralized protocols. After the Silicon Valley Bank collapse, many believe that the industry acquired a deep understanding of the value of fully decentralized stablecoin protocols. However, semi-decentralized stablecoins created for the sake of convenient user acquisition are not, in essence, decentralized stablecoins. When it comes to stablecoins, if there is a single aspect that is not decentralized, then the protocol is fundamentally not decentralized at all.

In the chart mentioned earlier, the only fully decentralized stablecoins are Liquity's LUSD and Reflexer's RAI. However, RAI does not peg to the US dollar, making it difficult to be widely recognized as a store of value. Its current circulation is also limited at only around 3 million tokens. This makes Liquity's achievements even more valuable. As a fully decentralized stablecoin, LUSD's market cap exceeds $260 million, following only DAI and FRAX. It has even surpassed ALUSD, which was once supported by DeFi godfather Andre Cronje, and even outperformed the so-called DeFi 2.0 cults, OHM and MIM. This showcases the success of Liquity.

Why is Liquity so successful?

Liquity’s Advantages

In addition to the significant advantage of being fully decentralized, when we look at Liquity's overall product design, the protocol’s liquidation mechanism is exceptionally well-designed, which is key to supporting business development. A robust liquidation system is the fundamental reason a stablecoin system can operate in the long term. Most stablecoin protocols on the market follow MakerDAO's auction model for liquidation.

Initially, MakerDAO's auction price started at 0 and increased until there were no new bidders, with the last bidder winning the collateral. However, this design caused huge losses for MakerDAO during the market flash crash on March 12, 2020, as the ETH network experienced skyrocketing gas fees and congestion. Many 0 DAI auctions won ETH during this period. Afterward, MakerDAO changed the auction to a reverse auction, starting the bidding at the collateral price equal to the debt price, then gradually lowering the price until someone was willing to bid, and extending the overall auction duration to prevent ODAI auctions from creating bad debt for the system.

The liquidation mechanism is at the core of lending system stability. When designing a liquidation mechanism, the primary consideration should be for extreme scenarios and eliminating any dependencies. MakerDAO's liquidation system still relies on the normal operation of liquidators, who need to weigh the gas fees and purchase DAI from the market when deciding whether to initiate liquidation.

Liquity's liquidation system, on the other hand, adopts an innovative and entirely different approach: the protocol designed a Stability Pool where anyone can deposit LUSD. This Stability Pool acts as the system's default liquidator. As long as there is LUSD in the pool, when a user's Trove faces liquidation, the Stability Pool will execute the liquidation: repaying the LUSD debt for the liquidated user and receiving the liquidated user's ETH collateral, which is then distributed among all Stability Pool users.

The advantages of this design are as follow:

Because the Stability Pool has been programmed in advance to act as the liquidator, liquidation can occur instantly without the need for liquidators to prepare LUSD or go through a complex auction process. The faster the liquidation occurs, the more the protocol's security can be guaranteed.

Because the protocol's security can be well maintained through the Stability Pool, Liquity allows users to have a collateralization ratio of only 110%, providing them with a more efficient capital utilization solution.

LUSD gains an additional use case. Depositing LUSD into the Stability Pool during times of severe market volatility can yield significant returns. Of course, the Stability Pool is not an end-all-be-all solution, especially when there is not enough LUSD in the pool during extreme market conditions to support all users' debts pending liquidation. Therefore, Liquity has also designed debt reallocation and recovery modes to maintain the safety and stability of the protocol during extreme market conditions. Liquity experienced market fluctuations just one month after its launch, as well as a series of dramatic market changes in 2022, proving the effectiveness of this liquidation mechanism.

Liquity's liquidation system design is outstanding. While ensuring the overall protocol security, it allows specific users to borrow at only a 110% collateralization ratio, achieving a combination of capital efficiency, decentralization, and price stability, which is rare in the overall stablecoin ecosystem.

Liquity's Shortcomings

Despite having a well-designed liquidation system, Liquity has two notable drawbacks:

Limited value of the LQTY token

Liquity’s collateral is limited to ETH and its governance-free features reflect overconfidence, which hinders end-user acquisition.

Let's first look at the LQTY token’s utility issue, which is determined by the protocol's fee structure. Liquity has a unique "no-interest" feature, meaning that LUSD holders do not have to pay interest but only a fee (generally 0.5%) when borrowing. According to Liquity's documentation, the team intends to encourage LUSD holders to maintain their holdings for an extended period through this approach.

This utility may indeed attract users to mint LUSD – to a certain extent – and motivate them to hold LUSD for the long term. However, over the long run, it also impairs the ability to earn revenue through protocol fees.

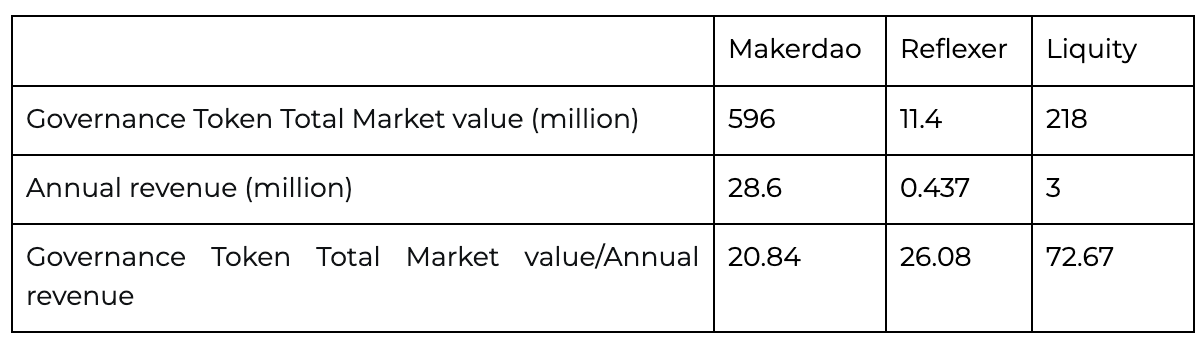

In this vein, we can compare Liquity with MakerDAO and Reflexer as all three governance tokens provide protocol revenue split incentives.

Yet, it is evident that LQTY's valuation is much higher than that of MKR and FLX. This is due to the fact that Liquity does not charge interest, while MakerDAO and Reflexer do. In other words, MKR and FLX can profit from a higher TVL, while a higher TVL for Liquity has no direct benefit to LQTY. Only when the market experiences significant volatility and users start minting and redeeming LUSD can LQTY potentially profit. However, Liquity's no-interest loan feature affects users' incentivization to mint and redeem, leading to an uncertain position for LQTY within the Liquity ecosystem.

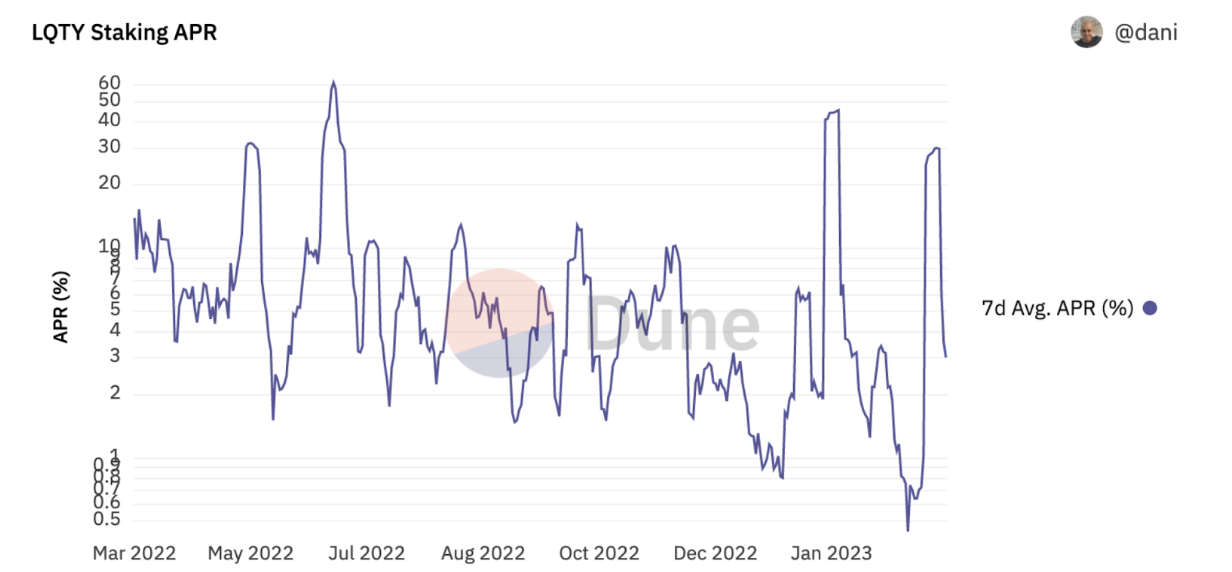

A direct result of this is that LQTY's staking APR is consistently low, rarely exceeding 10%. Moreover, LQTY lacks governance functions, and staking to earn interest is the only use case for LQTY. This low APR therefore significantly affects the confidence and willingness of LQTY holders to hold the token.

The second shortcoming is that collateral is limited to ETH and provides no governance features, which hinders Liquity's user acquisition.

Since the launch of the Liquity protocol, it has struggled in terms of user acquisition. The vast majority of LUSD still resides in the Stability Pool, and the only novel attempt to innovate, Chicken Bonds, has failed. This result is closely related to the team's non-governance attitude. While a governance-free protocol can circumvent potential risks introduced by manual operations, starting the protocol without governance right from launch demonstrates arrogance and indifference toward the future.

The world is fraught with change, and the DeFi world is even more so. Designs in 2021 may have been advanced at the time, but by 2023, there could – and should – exist opportunities for innovation. For example, if the team had introduced governance mechanisms, the shortcoming related to lack of utility for the LQTY token may have been alleviated. The most successful stablecoin protocols are the result of active governance by the teams, such as MakerDAO. Although its PSM has been criticized for being centralized, the decision was made collectively by MKR holders and has improved MakerDAO's rankings. Another leading stablecoin protocol, Frax, is an excellent example of active governance. Initially an algorithmic stablecoin, as the protocol matured, Frax promptly abandoned the algorithmic system to actively adjust FRAX circulation through an AMO mechanism and aggressively participated in the ‘Curve War’ by expanding staking, lending, and swap functions.

Holders of governance tokens clearly preferred a team like Frax rather than Liquity.

Established DeFi protocols are also actively engaging in governance to adapt to changes in the external environment. For example, DEX leader Uniswap launched V3 despite dominating the market with V2. Aave, the leader in lending, has continuously innovated and responded to market demand, evolving from the early ETHLend's Peer-to-Peer model to a Peer-to-Pool model, and eventually to the current V3 alongside the GHO stablecoin. Curve is also entering the stablecoin market itself.

A governance-free protocol is a beautiful vision, but with rapid change at the core of DeFi, governance is crucial to enable quick innovation.

Additionally, after the Shanghai upgrade, ETH enabled withdrawal from Beacon Chain, and we have seen ETH flooding into the risk-free “farms.” As such, the circulating ETH in the mainnet will increasingly exist in the form of liquid staking derivatives (LSD). How non-governance Liquity will cater to this portion of stablecoin demand remains uncertain.

Welcome to the World, ERD

Ethereum Reserve Dollar, “ERD,” aims to address the aforementioned issues with Liquity while maintaining the same level of decentralization, providing greater value as a governance token, and introducing widely distributed decentralized assets on the ETH network.

ERD is a decentralized lending protocol that enables users to borrow in USDE, a stablecoin pegged to the US dollar, using specified LSD Tokens (like stETH, ETH) and blue-chip Tokens (like Link, Aave) as collateral. It offers a minimum collateralization ratio of 110% and secures loans with a stable pool containing USDE and other Ethereum-based assets. ERD aims to address the dominance of centralized stablecoins and offer a truly decentralized, capital-efficient alternative. The benefits of ERD include low interest rates, efficient use of deposited LSDs, direct redemption of USDE for its underlying collateral at face value, and decentralization. Its goal is to become a truly decentralized reserve asset on the Ethereum network.

Long live Ethereum Reserve Dollar. On Ethereum, By Ethereum, For Ethereum.Follow ERD on social media and join our Discord for the latest protocol announcements and development updates:

- Website: https://www.erd.xyz

- Discord: https://discord.gg/VNwTAYwcHF

- X: https://twitter.com/Ethereum_ERD

- Github: https://github.com/Ethereum-ERD